- The price of Litecoin has increased by 3% in the last 24 hours.

- Market sentiment around the coin remained positive.

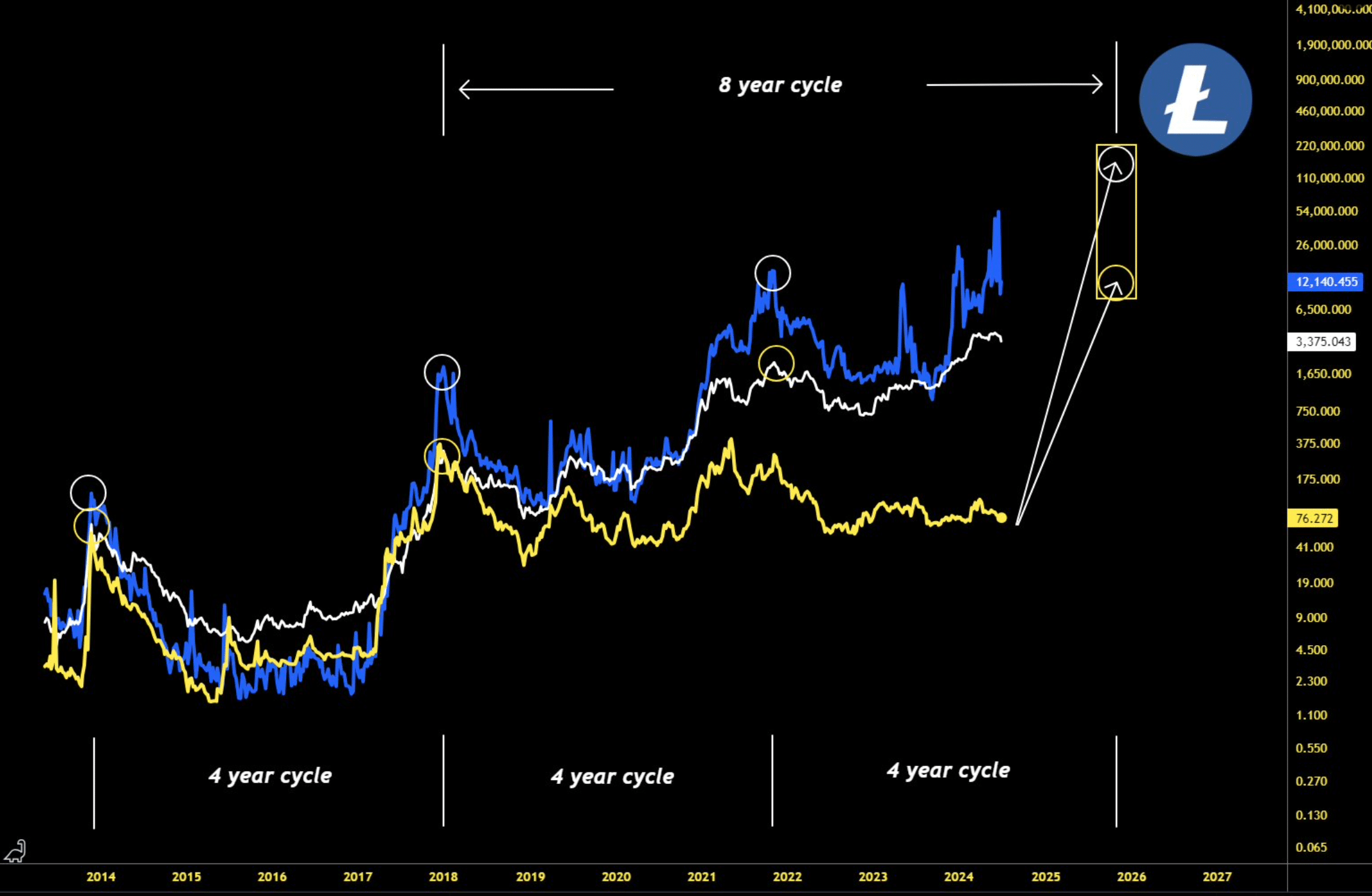

Litecoin [LTC]like most other cryptos, it struggled last month as it lost a substantial portion of its value. If we look at the latest data, LTC could be in an 8-year cycle, which seemed worrying at first glance.

But there is more to it.

What’s going on with Litecoin?

from CoinMarketCap facts revealed that the price of Litecoin has seen a correction of over 22% in the last 30 days alone. The downtrend has not stopped in the past week, as it has dropped by 13%.

While this was concerning, the last analysis van Master, a popular crypto analyst, revealed a different picture. According to the tweet, Litecoin is now in its 8-year cycle.

If true, investors will see LTC peak in October 2025. Historically, LTC peaks during every 4-year cycle. To be precise, during the years 2014, 2018 and 2022.

If history repeats itself, LTC could reach anywhere between $65,000 and over $100,000 at the next peak.

Source: X

This can be expected in the short term

Since it is still too early to look at the 2025 peak, AMBCrypto wanted to check the current state of the coin to see what can be expected in the short term.

The good news was that LTC, like several other cryptocurrencies, also saw an upward trend over the past 24 hours, with its price increasing by more than 3%.

At the time of writing, LTC was trading at $64.73 with a market cap of over $4.8 billion, making it the 21st largest crypto.

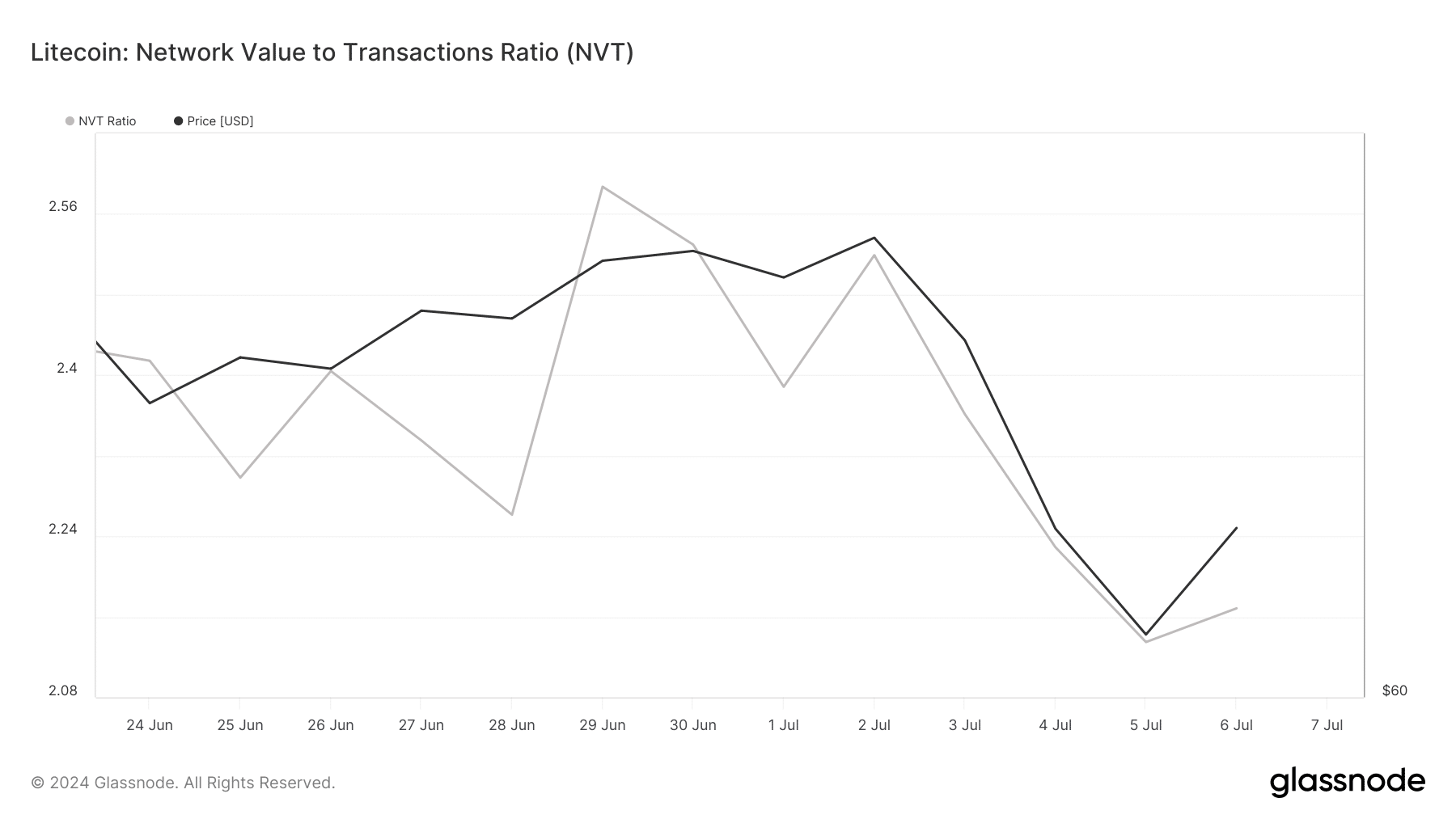

Things could get even better soon, as the coin’s NVT ratio dropped last week. A drop in the metric means an asset is undervalued, which signals a price increase.

Source: Glassnode

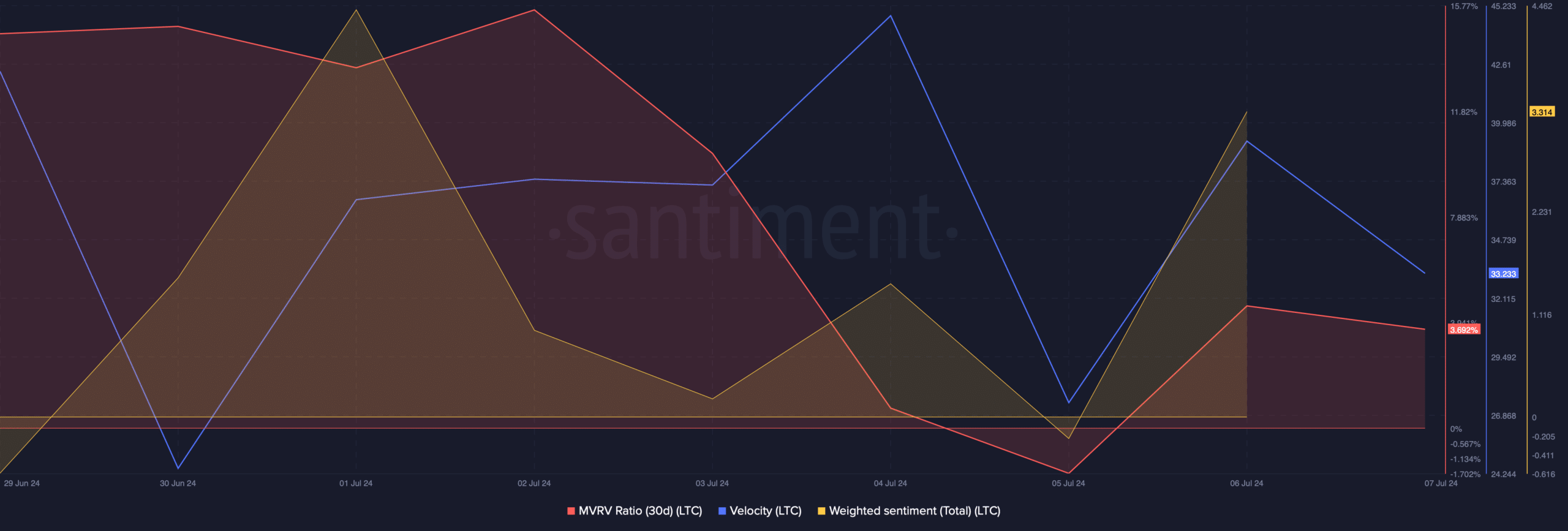

Investors’ confidence in the coin also seemed to have improved as the weighted sentiment went up. This clearly meant that the bullish sentiment around the coin was dominant in the market.

However, not every metric was optimistic. For example, the MVRV ratio registered a decrease. Velocity also decreased in the last few days, meaning that LTC was used less often in transactions within a certain time frame.

Source: Santiment

Is your portfolio green? Check the Litecoin Profit Calculator

Our analysis of Coinglass data showed that the long/short ratio also decreased, meaning that there were more short positions in the market than long positions.

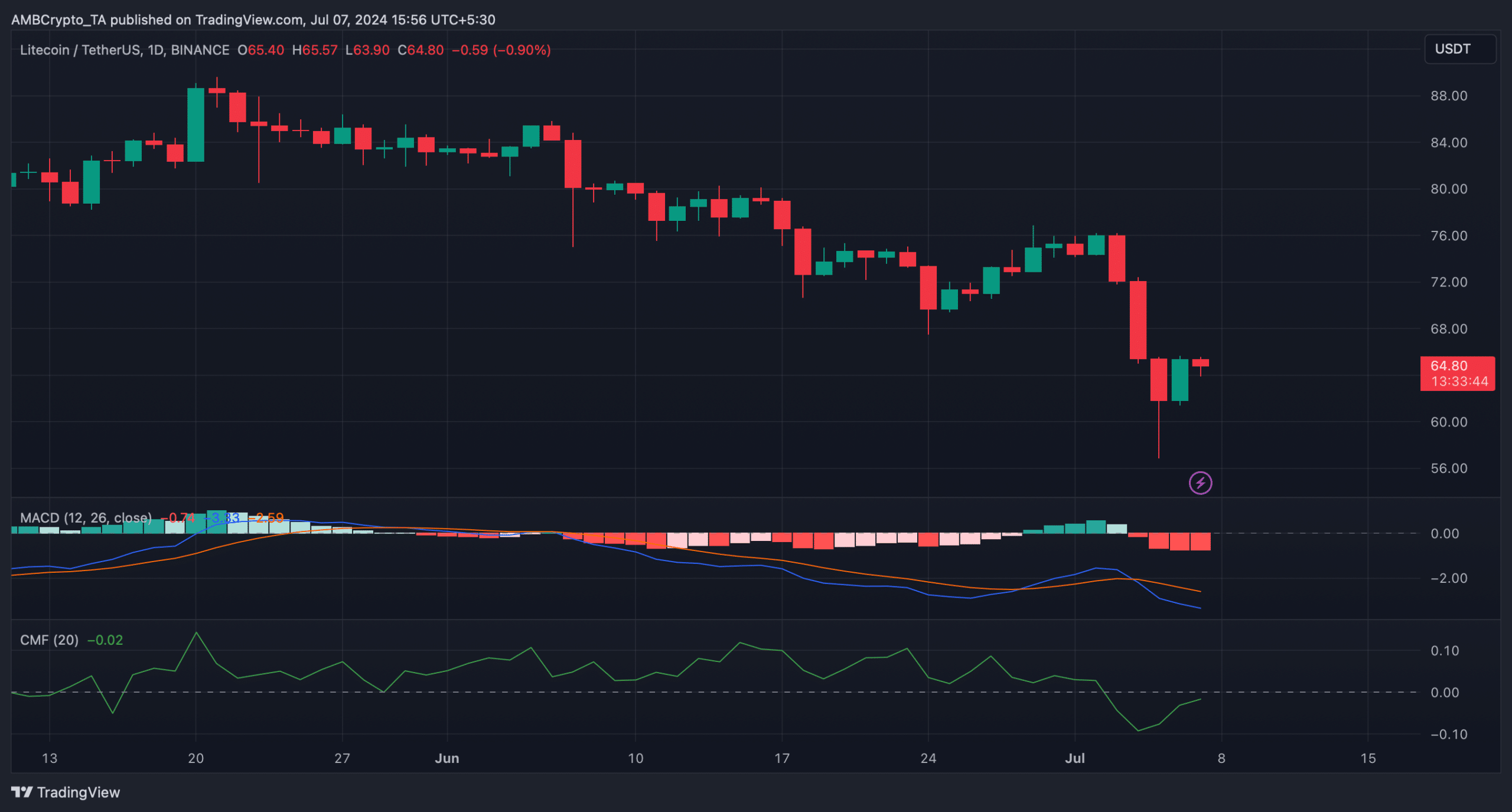

The MACD of the coin showed a bearish predominance in the market. Nevertheless, nothing can be said with the utmost certainty, as the Chaikin Money Flow (CMF) registered an uptick, indicating a sustained price increase.

Source: TradingView